Financial ignorance carries massive costs. Without an understanding of basic financial concepts, executives are not well-equipped to make decisions related to financial management. Study after study, as well as experts across the economical spectrum, agree that U.S. managers are uninformed about the basics of financial literacy to face the challenges of the future. While organizations are focused on closing the financial literacy gap, there is significant amount of work to be done to achieve true progress.

Why is financial literacy at all levels of management a basic need? The short answer is, that managers, from C-level executives to supervisors, who are financially literate appear poised to make a greater contribution to the organization’s overall profitability. As managers move up the organizational hierarchy these financial skills gain more importance.

The lack of financial literacy can be an enormous weakness for an organization: resources are wasted, opportunities are lost, and cash flow diminishes.

Lack of managers’ knowledge of current and expected future economic conditions have been at the heart of scandals for decades, ranging from Enron to Sunbeam.

Managers use financial statements for two primary reasons: 1.) To identify and focus interests of the organizations and where corrective actions should be taken, and 2.) To reassess projections about future performance.

Richard A. Lambert, Miller-Sherrerd Professor of Accounting at the Wharton School of the University of Pennsylvania, points out in his book Financial Literacy for Managers: “To provide effective support for decision making, organizations must provide managers with data that is compatible with their level in the organization and their areas of responsibility.”

What is the right level of financial literacy for your managers? The answer is not as simple as it seems. Everything trickles down to the organizational culture and the expectations of the management.

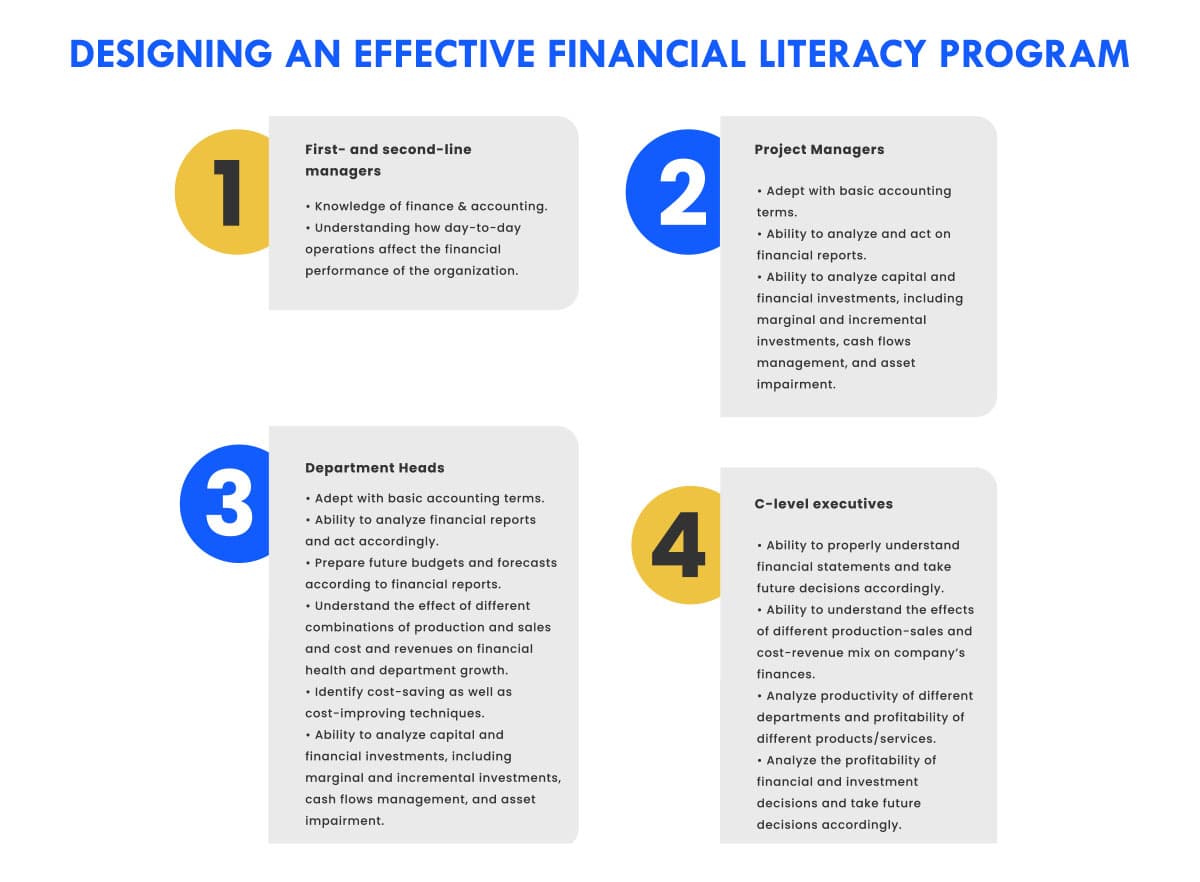

This table summarizes the basic levels of financial literacy required at different levels of management.

It can be used as a first step in designing an effective financial literacy program.

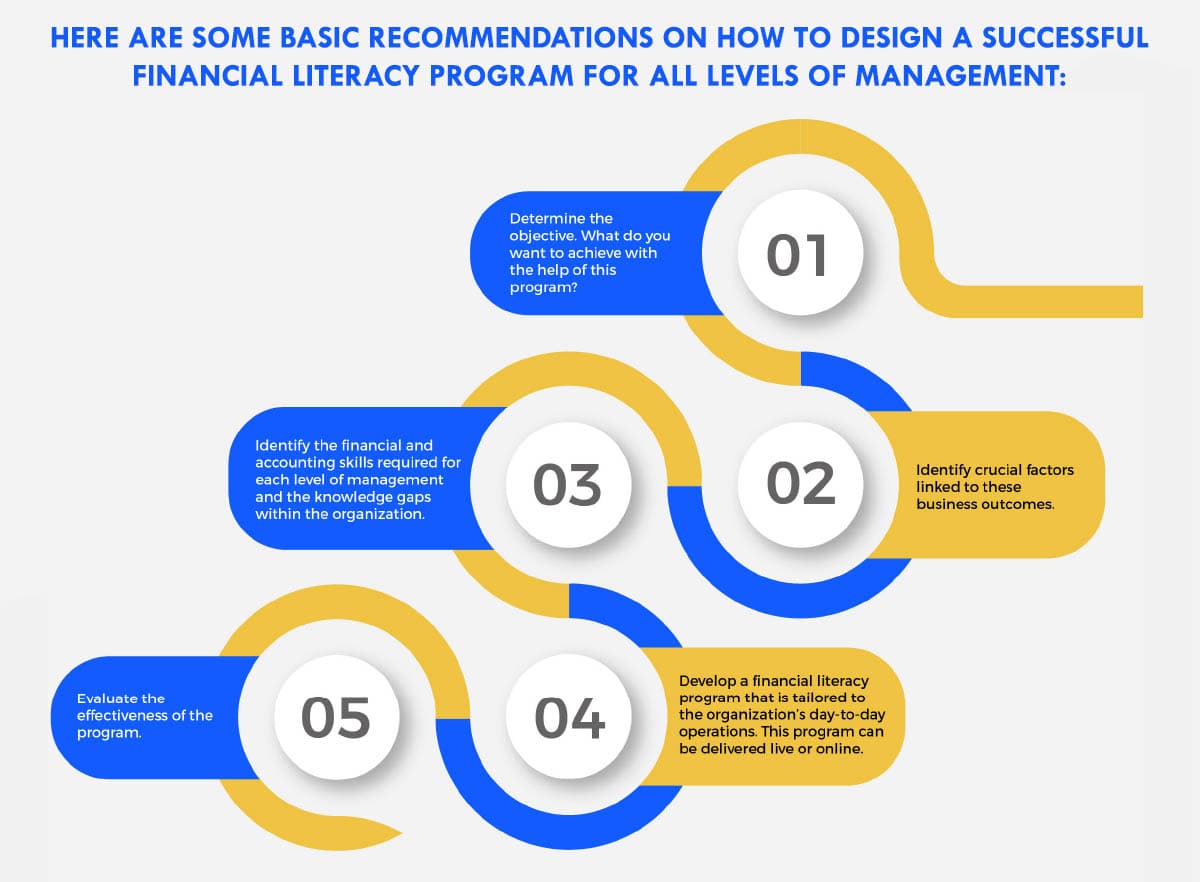

Designing a financial literacy program for each level of management is not an easy feat. It’s not a one-time event, whether it be a three-day seminar or a three-week training program. An all-comprehensive financial literacy program requires an understanding of the financial skills required to perform the job responsibilities, identifying the skills gap, developing content to fill these gaps, and an outcome assessment to ensure that each participant has learned and can apply the knowledge obtained.

Financial training programs for first- and second-line managers must begin with basic terminology.

An effective financial literacy program should clear concepts of finance and accounting in simple terms with examples that are relevant to the organization’s day-to-day operations. The instructional design of the program is key to achieving the learning objectives.

A successful financial literacy program should provide managers with opportunities to utilize their financial skills on a regular basis. With knowledge sharing, managers explore more opportunities with other members in the organization.

Joe Knight is widely considered as one of the world’s most influential finance and business literacy leaders. A conversation with Joe Knight about the value of financial literacy and how to close the existing knowledge gap in corporate America.

The HR Digest: Who is responsible for teaching financial literacy, parents or schools?

Joe Knight: It starts with good parenting and teaching financial concepts in the home, schools can supplement that.

The HR Digest: What’s the best strategy for helping managers to achieve financial literacy?

Joe Knight:First and foremost is to get into the numbers in your organization, a good organization should provide numbers to the managers at least monthly. Two to three key metrics should be identified and tracked. When I ran my own manufacturing company we evaluated and looked at metrics and statements on a weekly basis. There is power in sharing the numbers, good or bad, in an organization. I like to think of finance in an organization as a three-legged stool. First, share the numbers. Second, educate on the financial statements and how the numbers impact the business. Third, reward success through an objectively designed bonus system related to financial performance.

The HR Digest: What would you say is your specific contribution to closing the financial literacy gap that exists in corporate America?

Joe Knight: Training, training, training, interactive, basic training on the three statements, financial ratios, and the changing financial environment. One of the newest trends today is the focus on cash flow in an organization. The cash flow statement and the key cash metrics are the least well-understood metrics. Virtually every organization we encounter needs significant training for their managers and leaders in this area.

The HR Digest: What is the most useful financial advice you’ve received?

This article was published in the July 2019 issue of The HR Digest magazine.

Joe Knight | Principal Owner and Senior Consultant with the Business Literacy Institute

Joe Knight, Principal Owner and Senior Consultant with the Business Literacy Institute, is a highly regarded finance and business literacy keynote speaker and trainer. Joe works with managers and leaders at Fortune 500 companies such as NBCUniversal, General Electric, Berkshire Hathaway, Southwest Airlines, Boeing, United Technologies, and Electronic Arts.

Joe is co-author of Financial Intelligence, a smart, no-nonsense business finance handbook for managers. The book has been heralded as “the Elements of Style” of finance by CFO.com. Financial Intelligence was featured in The 100 Best Business Books of All Time and has been turned into a graphic novel by Smarter Comics. Joe also co-authored Project Management for Profit which outlines the easy-to-implement system he helped create at Setpoint to manage projects towards profitability no matter what stage the project is in. Joe has also written toolkits for Harvard Business Press including the ROI Toolkit, Understanding EBITDA, and the Business Valuation Toolkit. He has also been a guest on CNBC’s Morning Call program.

PHOTO: BUSINESS LITERACY INSTITUTE

Subscribe to the leading HR Magazine to receive exclusive Human Resources news and insights directly to your inbox.